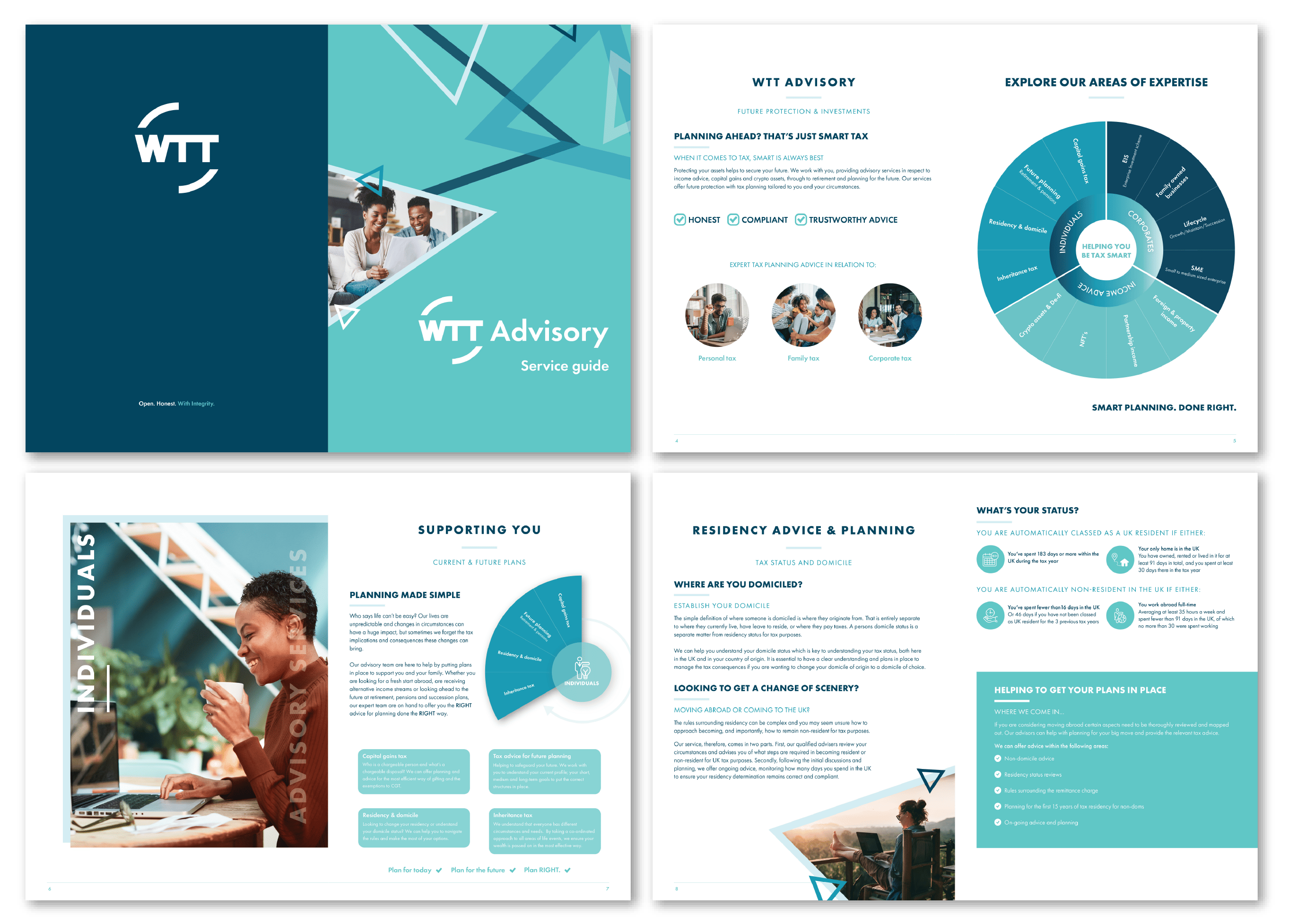

Advisory services

Planning ahead? That’s just smart tax.

When it comes to tax, smart is always best. Protecting your assets helps to secure your future. We work with you, providing advisory services in respect to income advice, capital gains and crypto assets, through to retirement and planning for the future.

Our services offer future protection with tax planning tailored to you and your circumstances.

Individuals

Personal tax advisory

Who says life can’t be easy? Our lives are unpredictable and changes in circumstances can have a huge impact, but sometimes we forget the tax implications and consequences these changes can bring.

- Inheritance tax

- Residency & domicile

- Income advice

Family

Family tax advisory

As well as your own personal tax needs, life events can also have a huge impact on how you manage your family tax portfolio. From births and deaths, to marriages and divorces, there are many factors which can change your tax status. We offer a wide range of services around inheritance tax planning and trusts, retirement tax advice and family businesses.

- Succession planning

- Family run businesses

- Asset management

Businesses

Corporate tax advisory

If you own your own business, not only do you have personal tax matters to consider, it is also important to implement certain structures to safeguard your business and maximize its future.

- Business life-cycle

- Outsourced Financial Director Service (FDS)

- PSC services

IR35 Hub

IR35 Hub

While the risk sits with the fee-payer – usually the employer or the agency depending on who pays the contractor – it’s important you understand the implications. We provide all the advice and support you need to put you in the best position.

Enter the hub

Tom Wallace

Director

Tom joined WTT in 2017, setting policy and strategy for clients having their tax affairs enquired into after a 20 year career with HMRC, primarily in tax investigations. As a qualified tax inspector, he led teams across business segments from global household names to mid-size businesses. After joining the newly formed Complex Evasion team he investigated offshore structures, providing a unique insight into tax compliance.

Jerry Giles

Head of Tax Advisory

Jerry joined WTT in 2023 as Head of Tax Advisory. Jerry trained with a City of London accountancy firm, qualifying as a Chartered Certified Accountant in 1999. In 2001, he joined a Tunbridge Wells based firm of Chartered Accountants, Registered Auditors and Chartered Tax Advisors where he developed his skills in private client tax planning for individuals and OMB corporate clients as well as developing and finding new business. He set up his own consultancy in 2007 and has provided independent bespoke advice to UK taxpaying clients.

Service brochure

Download our service brochure

Smart planning. Done right

Download a copy of our WTT Advisory service guide and discover how we can assist all your tax advisory needs.

Arrange a callback

We’d love to hear from you!

Whether you simply have a quick question, or were seeking a more formal conversation to discuss your tax needs, drop your details here and we will be in touch! Alternatively, you can contact us on +44 (0)20 3468 0000.